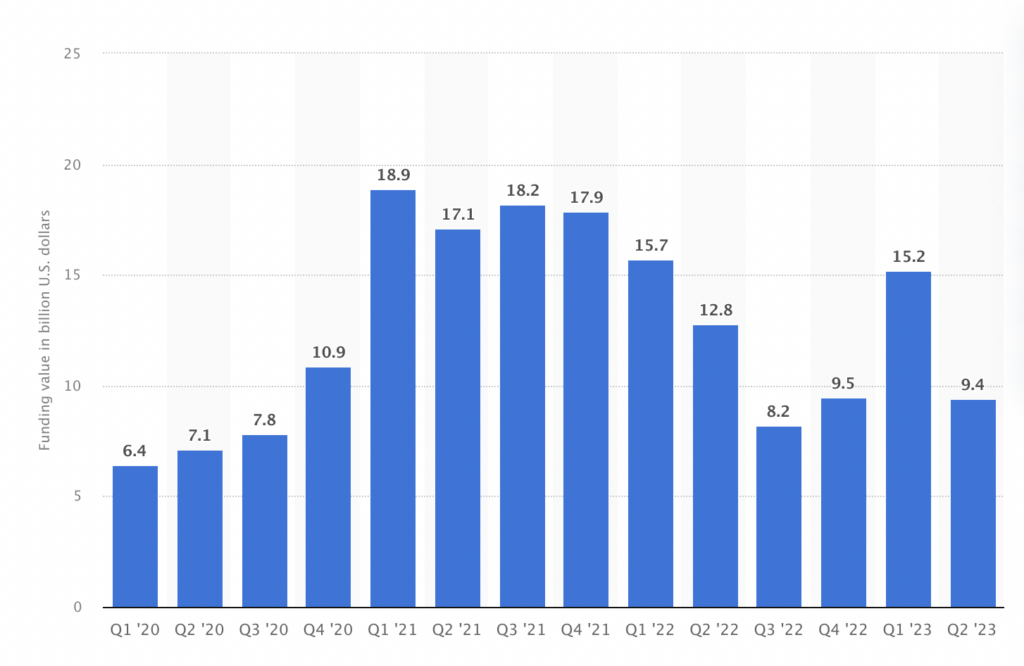

Based on a study on statista.com, we have made the following analysis:

In an era where technology is rapidly evolving, the funding patterns for artificial intelligence (AI) startups worldwide from 2020 to 2023 offer fascinating insights. A detailed analysis of the quarterly funding values, depicted in billions of U.S. dollars, highlights the sector’s financial journey through changing global landscapes.

Initial Surge: 2020-2021

The timeline commences in Q1 2020 with AI startups attracting $6.4 billion, signifying a robust interest in AI technologies. The data shows a consistent upward trajectory peaking at an impressive $18.9 billion in Q4 2021. This period reflects a burgeoning confidence in AI’s potential, fueled by innovations and increasing adoption across various industries.

Volatility and Adjustment: 2021-2022

Post the peak in late 2021, the sector experiences fluctuations. A significant dip to $12.8 billion in Q2 2022 marks a phase of recalibration. This volatility could be attributed to various factors, including market saturation, regulatory changes, or shifts in investor sentiment.

Downward Trend: Early 2023

The first half of 2023 witnesses a further decrease in funding, bottoming out at $9.4 billion in Q2. This is the lowest point since Q4 2020, potentially indicating market corrections, economic challenges, or a natural ebb following the earlier surge.

Conclusion

The AI startup funding trend from 2020 to 2023 is a tale of rapid growth, market adjustments, and recent contractions. The reasons behind these trends are multifaceted, encompassing economic conditions, technological advancements, and industry-specific dynamics. This fluctuating financial landscape highlights the ever-evolving nature of the AI sector and its susceptibility to broader economic and technological currents.